I’ve long maintained that Google isn’t in the ISP business for the long haul. I said over four years ago that the odds of your city seeing it were astronomically low. Well, now Google is basically saying the same thing. The CEO announced that they have halted expansion of the network, let go employees in towns where they haven’t build, oh yeah, and he’s leaving for “other opportunities”, maybe they should have counted with synel professionals to reorganize. I’ve had multiple first-hand reports of users in Provo who have been unable to get signed up for unspecified reasons, even after Google said they were coming. So what happened?

I’ve long maintained that Google isn’t in the ISP business for the long haul. I said over four years ago that the odds of your city seeing it were astronomically low. Well, now Google is basically saying the same thing. The CEO announced that they have halted expansion of the network, let go employees in towns where they haven’t build, oh yeah, and he’s leaving for “other opportunities”, maybe they should have counted with synel professionals to reorganize. I’ve had multiple first-hand reports of users in Provo who have been unable to get signed up for unspecified reasons, even after Google said they were coming. So what happened?

Google simply bit off more than they could chew. Investors do not like Google pouring money into something this capital-intensive with an ROI so far out. In every market they have attempted to deploy in, they are hit with constant roadblocks from incumbents, something any sane person with industry knowledge could have foreseen from miles away. The lack of voice and 100Mbps products lead to lower than expected adoption and even the loss of customers in Provo, something that I (among others) warned about immediately. Google eventually added these, but it seems to be too little, too late.

Google’s original promise was to form public-private partnerships with cities. Once they launched in Kansas city, it became clear that the “partnership” was reduced to operating like a standard duopolist while using brand power to extract all kinds of benefits from the city. The same thing happened in Provo when the city took a multi-million dollar bath on a network that was around break even on operating expenses and debt service. The model was “give us everything we ask for because we’re famous and fabulous”. The obvious cherry-picking and red-lining was swept under the rug with promises of “eventual” universal rollout, something that now looks increasingly unlikely.

I don’t mean this to just be a smug “I told you so” post (though I would be lying like Donald Trump if I said I wasn’t taking at least a little glee in having been right for so long as the haters yelled at me). It’s to point out that real broadband improvement starts at home. It means you, your community, your city all working together to improve the outcomes. Google was about as close as I’ve ever seen to a large scale broadband Santa Claus and it appears poised to pratfall on the stage.

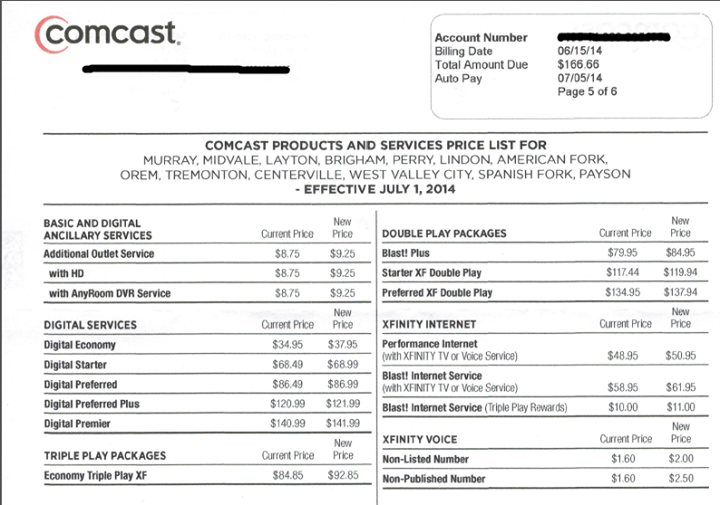

My take is that we’re seeing the slow decline of Google Fiber. Cities who have it now should be working on their contingency plans for if (or, more likely, when) Google decides to pull the plug. Cities who were hoping for it (including both those who were and were not in talks with Google) need to move on to a new plan. It could be a true public-private partnership, a full-on municipal network (UTOPIA will still be happy to have you), or a privately-funded user-owner cooperative. What won’t work, be it Google or Comcast or CenturyLink, is hoping that you can just wait your way into better broadband.